What is a Legal Entity Identifier?

Updated:

A legal entity identifier (LEI) is a 20 digit code developed by the Global Legal Entity Identifier Foundation (GLEIF)1 to help primarily financial services companies meet Know Your Customer (KYC) requirements.

The Problem LEI is Trying to Solve.

The global legal entity identifier attempts to accomplish two objectives:

- Improve risk management for financial services companies, and

- Enhance marketplace integrity between counterparties.

The ownership, and even existence, of legal entities is opaque, in cross border transactions.

Anyone dealing with a business needs to know that the legal entity is not a fraud and has the authority to do business. Even small and medium-sized businesses can consist of a complex corporate structure. It is important to know each entity in the counterparty’s structure.

The lack of standardization, especially across borders, increases transaction costs and slows deals.

The GLEIF attempts to address these problems by assigning each entity a new LEI code. It also tries to capture the parent and subsidiary entities.

Legal Entity Identifiers in the United States

The GLEIF LEI is part of a larger concept of legal entity identifiers. In the United States, for example, there are four primary legal entity identifiers for business entities:

- Federal Employer Identification Number (EIN or FEIN),

- State registration number,

- Tax Identification Number (for sole proprietors), and

- D-U-N-S Number (from Dun & Bradstreet).

Employment Identification Number (EIN)

The Internal Revenue Service (IRS) issues Federal Employer Identification Numbers (EIN) to business entities. Business entities must apply for an EIN if these statements are true:2

- The business has employees,

- The business is a corporation or partnership, which includes limited liability companies,

- The business files certain types of tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms,

- The business withholds non-wage income to non-resident aliens,

- The business has a Keogh plan, or

- The business is involved with trusts3, estates, real estate mortgage investment conduits, non-profit organizations, farmer’s cooperatives, or plan administrators.

Business entity numbers assigned by Secretaries of State

Many Secretaries of State issue a legal entity identifier to business which corporate or file in those states. California, for example, says:

The identification number assigned to a business entity by the California Secretary of State at the time of registration. A corporation entity number is a 7 digit number with a C at the beginning. A limited liability company and limited partnership entity number is a 12 digit number with no letter at the beginning.4

Those state issued numbers are not standardized. They also do include any ownership information, simply the registered agent for service of process.

Tax Identification Number (TIN)

The Tax Identification Number (TIN) is, technically, a class of identification numbers. All EINs are TINs, but not all TINs are EINs.

That said, most legal entity professionals (business lawyers, bankers, and accountants) use TIN to refer to the tax identification of a natural person. For most US citizens their TIN is their Social Security Number (SSN). The implication for sole proprietors is that their SSN is their TIN.

Of course, sole proprietors are the most common type of business entity.

What about Single Member Limited Liability Companies? These LLCs are incorporated in a state and have only one owner. They generally get the benefit entity protection and are disregarded for tax purposes. What legal entity identifier do they use? It depends. See this IRS guidance for more information on identifiers for Single Member Limited Liability Companies.

D-U-N-S Number

The Dun & Bradstreet Number or D-U-N-S Number (DUNS) is a privately issued number from the Dun & Bradstreet company (D&B).5 A D-U-N-S Number is a unique 9 digit number available to any business entity which applies for one with D&B.

These four types of entity identifiers are just the most common. There are more legal entity identifiers in the United States.

LEI and Ownership.

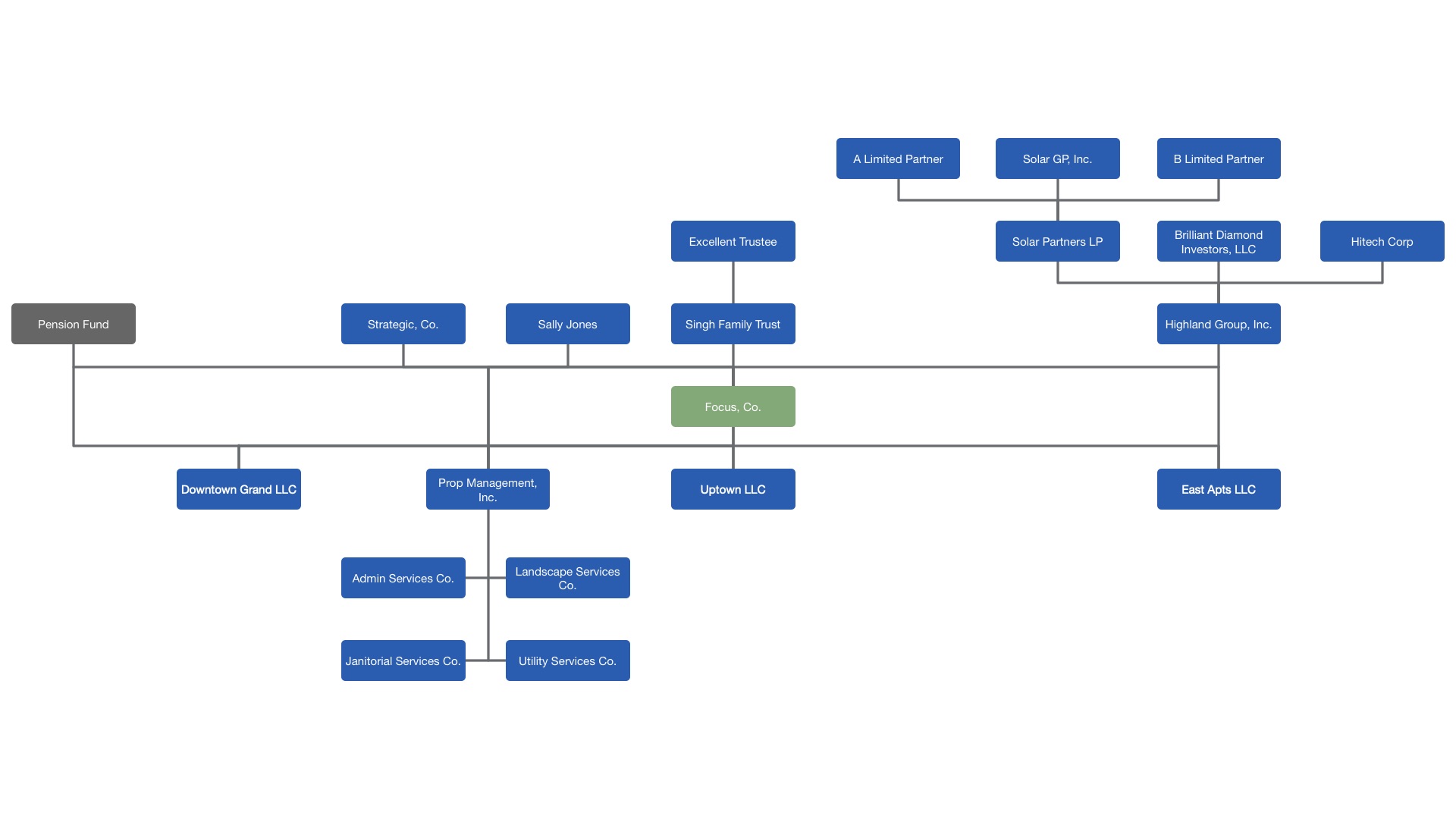

One of the central problems with existing legal entity identifiers is that they only identify the entity in question. It can be quite difficult to verify ownership information. The GLEIF promotes transparency about ownership by distinguishing between purely biographic data (“Level 1” data) and ownership data (“Level 2” data).

Level 2 information specifies “who owns whom.”

The LEI data set is probably not rich enough yet to create complete corporate org charts. It is still a good place to start for entities that are in the LEI dataset.

Conclusion.

The LEI number from the Global Legal Entity Identifier Foundation is the latest attempt to standardize on a universal number for identification of legal entities. Whether it gets traction outside global financial transactions remains to be seen.

It is an important contribution of the GLEIF to include ownership information.

Legal entity identifiers are an integral part of entity management. Until there is a single entity identifier, US businesses will need to track the EIN, state registration number, D-U-N-S number, and, potentially, the LEI number for each entity in the corporate family.

Entity management software is the best way to manage all the legal entity identifiers.

Business Search - Frequently Asked Questions, California Secretary of State ↩︎