Practical Guide to the Corporate Transparency Act

Updated:

The most sweeping federal law since the creation of national income taxes takes effect in 2024 for small businesses. The Corporate Transparency Act requires that every small business report who owns and controls the business to the federal government.

If your business makes less than $5 million a year or has 20 or fewer workers, it’s considered a small business under the Corporate Transparency Act (CTA). You must report who owns and controls your business to the Financial Crimes Enforcement Network (FinCEN)

The CTA requires businesses to keep sending in information about their owners any time the information changes. An owner moves: file a report. Create a new DBA: file a report. Form a subsidiary: file a report.

This law is strict and focuses on small businesses. If you don’t follow the rules, there could be big fines or even criminal charges.

The Corporate Transparency Act (CTA) is a recent law that tells small businesses they must file Beneficial Ownership Information (BOI) Reports about their owners with the Financial Crimes Enforcement Network (FinCEN). Regulations and implementation by FinCEN take effect in 2024. This guide includes what you need to know.

Who has to file Beneficial Ownership Information (BOI) Reports?

The CTA requires businesses formed in the United States or foreign businesses registered to do business in the United States to file BOI Reports with FinCEN. These businesses are called Reporting Companies.

You can access a dynamic version of this domestic and foreign company diagram in Lexchart.

Reporting Companies

The CTA requires a Reporting Company to file a BOI Report with FinCEN. A Reporting Company is a corporation, limited liability company, or other similar entity that is created by the filing of a document with a secretary of state.1 Reporting companies include businesses formed in countries other than the United States, but registered to do business in the U.S.

Based on this definition, you would be forgiven if you thought the Corporate Transparency Act applied to nearly all businesses. That is not correct.

Exemptions

There are 23 exemptions that allow business to avoid being classified as “Reporting Company.” As a practical matter, one exemption is critical for small businesses.

The following businesses are not Reporting Companies and do not have to file a BOI Report with FinCEN:

| No. | Exemption Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Exemptions 1 through 18 apply to businesses that are already regulated by the federal government.

Exemption 19 applies to tax-exempt entities, such as 501(c)(3) organizations, which do not have owners in the traditional sense of for-profit businesses. Exemption 20 relates to the non-profit exemption #19.

Exemption 23 applies to legal entities that are inactive, meaning that they are not engaged in any business activity.

That leaves Exemption 21 and Exemption 22. Exemption 21 applies to a business that has more than 20 employees and more than $5 million in gross receipts or sales. These are called “Large Operating Companies” in the CTA. Exemption 22 applies to a business that is owned by a Large Operating Company. These are called “Subsidiaries of Certain Exempt Entities” in the CTA.

The net effect of the reporting requirement and the exemptions is that small businesses must file Beneficial Ownership Information (BOI) Reports with FinCEN, but large companies do not. A small business under the Corporate Transparency Act (CTA) is any business that has less than $5 million in sales or employs 20 or fewer employees.

How many businesses are affected by the CTA? There is no precise number but the scale is large:2

The Small Business Administration (SBA) estimates that there are 5.4 million businesses with 1-19 employees.3 These business are all Reporting Companies under the CTA. This SBA estimates that there are approximately 27 million sole proprietorships. These are not “Reporting Companies” unless they are organized as LLCs or Corporations.

Who is a Beneficial Owner?

Beneficial ownership is not simple under the Corporate Transparency Act. A Beneficial Owner is an individual who exercises substantial control over a Reporting Company or owns or controls 25% or more of the ownership interests of a Reporting Company.

You can access a dynamic version of this diagram of beneficial ownership under the Corporate Transparency Act in Lexchart.

The Reporting Company must identify and list all Beneficial Owners. There is no limit to the number of Beneficial Owners.

25% or more ownership interest

The first part of the definition of Beneficial Owner is an individual who owns or controls 25% or more of the ownership interests of a Reporting Company. This is the traditional definition of ownership. If you own 25% or more of a business, you are a Beneficial Owner.

For most small businesses, this ownership test is the only part of the definition that matters. If you own 25% or more of a business, you are a Beneficial Owner.

Small businesses often have a single “class” of ownership interests. For example, if you own 25% or more of the stock in a corporation, you are a Beneficial Owner. If you own 25% or more of a limited liability company membership interests, you are a Beneficial Owner.

Ownership can be complicated in several ways under the Corporate Transparency Act dragging more people into the class of beneficial owners.

Direct and indirect ownership

Ownership can be direct or indirect. Direct ownership is when you own an ownership interest in a business. Indirect ownership is when you own an ownership interest in a business that owns an ownership interest in another business.

You can access a dynamic version of this diagram of indirect ownership under the Corporate Transparency Act in Lexchart.

For example, if you own 25% or more of the stock in a corporation, you are a Beneficial Owner. If you own 25% or more of the stock in a corporation that owns 25% or more of another corporation, you are a Beneficial Owner.

The chain of indirect ownership can be long. For example, if you own 25% or more of the stock in a corporation that owns 25% or more of another corporation that owns 25% or more of another corporation that owns 25% or more of another corporation, you are a Beneficial Owner.

Ownership interests

Ownership interests can be voting or non-voting. Voting interests are ownership interests that have the right to vote on the management of the business. Non-voting interests are ownership interests that do not have the right to vote on the management of the business.

[Any equity, stock, or voting rights] interest classified as stock or anything similar, regardless whether it confers voting power or voting rights, and even if the interest is transferable.4

There are several types of ownership interests according to FinCEN for CTA compliance.

Equity, stock, or voting rights

- equity, stock or similar instrument,

- pre-organization certificate or subscription,

- transferable share an equity security,

- voting trust certificate for an equity security,

- certificate of deposit for an equity security,

- an interest in a joint venture, or

- certificate of interest in a business trust.

Capital or profits interest

- any interest in the assets or profits of a limited liability company,

- LLC membership interest, or

- LLC unit.

Convertible instruments

- any instrument convertible into an equity, stock, or voting right, or

- any instrument convertible into a capital or profits interest, or

- any future on any convertible instrument, or

- any warrant or right to subscribe to or purchase, sell, or subscribe to a share or interest in an equity, stock, or voting right, or capital or profits interest, even if such warrant or right is a debt.

Options or privileges

Ownership interests also include options or privileges. This means that any put, call, straddle, or other option for equity, stock, or voting rights, or capital or profits interest, is an ownership interest.

There is an exception for an option that is created and held by other investors without the knowledge or involvement of the reporting company.

Catch-all ownership interests

Finally, there is a catch-all for any other interest in a business that confers the right to share in the profits or losses of the business. This means any instrument, contract, arrangement, or understanding that gives the holder an ownership interest in the business.

Substantial control

The other part of the definition of Beneficial Owner is an individual who exercises substantial control over a Reporting Company. This is the non-traditional definition of ownership. A person who exerts substantial control over a business is a Beneficial Owner under the Corporate Transparency Act.

Substantial control is separate and apart from ownership. You can be a Beneficial Owner without owning any part of the business.

Someone has substantial control if any one of the following are true:

- the person is a senior officer,

- the person has authority to appoint or remove senior officers or a majority of directors of the Reporting Company, or

- the person is an “important decision-maker”, or

- the individual has any other form of substantial control over the Reporting Company.

This interpretation of substantial control is very broad.

Senior officer

A senior officer is an individual who has responsibility for the management and direction of the Reporting Company.

You can access a dynamic version of this organizational chart of senior officers as beneficial owners under the Corporate Transparency Act in Lexchart.

Examples of clear cases from FinCEN include the following individuals who are senior officers of a Reporting Company:

- Chief executive officer,

- President,

- Chief financial officer,

- Chief operating officer,

- General counsel (or corporate counsel), or

- Any other officer, no matter what the title, who performs similar functions.

It is important to note that the title of the individual is not primary factor. The function of the individual is the key. The function of the individual is to direct, determine, or have substantial influence over the business. For example, an “EVP of Corporate Development” might have substantial control if that person makes decisions about mergers and acquisitions.

Appointment or Removal Authority

An individual has authority to appoint or remove senior officers or a majority of directors if the individual has the power to appoint or remove senior officers or a majority of directors of the Reporting Company, either directly or indirectly.

Important decision-maker

An individual is an important decision-maker if the individual directs, determines, or has “substantial influence” over important decisions.

What is an important decision?

Important business decisions relate to strategy. Business decisions include questions about the nature and scope of the business. Strategic decision about entering or ending a line of business would count. The ability to choose a geographic territory, for the business is an example of an important business decision. Even the ability to enter or terminate, a contract is an important business decision, provided the contract is “significant” for the business.

Financial decisions are important if they concern the sale, lease, mortgage, or transfer of assets critical to the business. Financial decisions also include the purchase or sale of goods or services that are critical to the business. Compensation schemes and incentive plans are also important financial decisions.

Any structure decision about the business is important. This includes decisions about the legal structure of the business, such as reorganization, dissolution, or merger. Amendments to governance documents are also important structure decisions.

Catch-all substantial control

Like Ownership Interests, there is a catch-all for any other form of substantial control over the Reporting Company. This means any other form of control over the business. This is designed to capture governance or management schemes that FinCEN has not thought of yet or might evolve in the future.

All of these characteristics of substantial control are simply designed to prevent Reporting Companies and individuals from avoiding the filing requirement by using a different title or a different form of control.

What are the Exceptions to Beneficial Ownership?

FinCEN’s interpretation of Beneficial Ownership is sweeping. It is designed to capture as many individuals as possible. There are, however, several limited exceptions to Beneficial Ownership.

Minor child

Children do have to be listed as Beneficial Owners. Instead, the Reporting Company must list the parent or guardian of the minor child.

Once the child reaches the age of majority, the Reporting Company must file an update to the BOI Report to list the child as a Beneficial Owner.

Nominee, intermediary, custodian, or agent

If someone only acts on behalf of an actual beneficial owner as an agent, then the agent does not have to be listed as a Beneficial Owner.

This exception applies to individuals who provide services such as tax advice. Even if the exception applies, the underlying beneficial owner must still be listed.

Employee

At first glance, it seems like there is a conflict between officers (who are employees) of a company and the employee exception. The employee exception, however, only applies to employees who do not have substantial control over the business.

There are three requirements for the employee exception, all of which must be satisfied:

- the individual is an employee (there is a specific legal test for that status),

- the individual has substantial control over the business only because of the individual’s employment status, and

- the individual is not a senior officer (see Senior Officers).

Inheritor

Someone who will receive an ownership interest in the future does not have to be listed as a Beneficial Owner. This exception applies to someone who will receive an ownership interest in the future, such as a beneficiary of a will.

Once the person inherits the interest, however, the Reporting Company must file an update to the BOI Report to list the person as a Beneficial Owner.

Creditor

A person who is a creditor of a Reporting Company is not a Beneficial Owner. This exception applies to a person who has a security interest in the assets of the Reporting Company. This exception applies provided that the debt is the sole reason for the person’s interest in the Reporting Company.

If, for example, the debt instrument is convertible into an ownership interest in the Reporting Company, then the person is a Beneficial Owner (see Convertible Interests).

These exceptions differ from the exemptions. The exemptions are for entire businesses. The exceptions are for individuals listed on a BOI Report.

Who is a Company Applicant?

The Corporate Transparency Act requires Reporting Companies to list the Company Applicants uncertain circumstances.

A Company Applicant is an individual who files an application to form a Reporting Company or registers a Reporting Company to do business in the United States. These are individuals who file, or cause someone to file, Articles of Incorporation or Articles of Organization with a Secretary of State or similar office.

For example, if you hire a lawyer to form a corporation for you, both you and the lawyer (or more likely, the paralegal or legal assistant) are Company Applicants. If you file Articles of Incorporation yourself, you are the Company Applicant.

What Reporting Companies have to report Company Applicants?

Businesses formed (or registered to do business) before January 1, 2024, do not have to report Company Applicants. Businesses formed (or registered to do business) after January 1, 2024, must report Company Applicants.

This is a critical timing issue. If your business was formed or registered before January 1, 2024, you do not have to report Company Applicants. If your business was formed or registered after January 1, 2024, you must report Company Applicants.

What information do Company Applicants have to report?

The required information for Company Applicants is described in the Part II. Company Applicant Information section of the What is a Beneficial Ownership Information (BOI) Report? section.

What is a Beneficial Ownership Information (BOI) Report?

A Beneficial Ownership Information (BOI) Report tells FinCEN who the Company Applicants and Beneficial Owners of a Reporting Company are. There are four sections of the BOI Report: Filing Information, Reporting Company, Company Applicants and Beneficial Owners.

There are three ways to file a BOI Report:

- Online through the FinCEN website,

- Electronic submission of a PDF form, or

- Through a third-party service provider.

The online form is straight forward. You can download the step-by-step instructions for the online form from FinCEN.

The PDF form can be tricky. The PDF form requires that you open the file with Adobe Acrobat Reader. Opening the PDF with another native PDF reader, such as Preview on a Mac, will not work.

The PDF version of the BOI Report is available from FinCEN along with step-by-step instructions for the PDF form.

The PDF and online versions of the BOI Report request the same information:

- Filing Information: questions about the particular report,

- Part I: questions about the Reporting Company,

- Part II: questions about the Company Applicants (if applicable), and

- Part III: questions about the Beneficial Owners.

Filing Information

The Filing Information section of the BOI Report is about the particular filing. The BOI Report is not like a tax return (once a year) or a business license (once every few years). The BOI Report is a continuing obligation.

The Filing Information section starts by asking for the Type of filing. There are four choices:

- Initial report,

- Correct prior report,

- Update prior report, or

- Newly exempt report.

Initial report option

The Initial report is the first BOI Report filed by a Reporting Company. Choose this option if the Reporting Company has never filed a BOI Report before.

Correct prior report option

The Correct prior report is used to correct a BOI Report that was filed with incorrect information. Choose this option if the Reporting Company has filed a BOI Report before and needs to correct it.

This choice will open additional fields on the form that allow FinCEN to link the corrected BOI Report to the prior BOI Report.

Update prior report option

The Update prior report is used to update a BOI Report that was filed with correct information. Choose this option if the Reporting Company has filed a BOI Report before and needs to update the Beneficial Ownership information.

It is unlikely that the Company Applicant information will change. It is more likely that the Beneficial Owner information will change. For example, if a Beneficial Owner sells their interest in the Reporting Company, the Reporting Company must file an Update prior report to remove the Beneficial Owner.

Newly exempt report option

The Newly exempt report is used to report that a Reporting Company is no longer required to file BOI Reports. Choose this option if the Reporting Company was previously required to file BOI Reports, but is now exempt. See the Exemptions section for more information.

Part I. Reporting Company

The Reporting Company information is the name, address and other identifying information. Part I of the BOI Report has four sections:

- Full legal name and alternate name(s),

- Form of identification,

- Jurisdiction of formation or first registration, and

- Current U.S. address.

Full legal name and alternate name(s)

The full legal name of the Reporting Company is the name that appears on the Articles of Incorporation or Articles of Organization filed with the Secretary of State or similar office.

The alternate name(s) are any other names that the Reporting Company uses to do business. For example, if the Reporting Company is a corporation, the alternate name(s) would include any fictitious business names filed with the Secretary of State or similar office. Each trade name or doing business as (DBA) name must be listed separately.

Form of identification

The BOI Report must provide the tax identification number of the Reporting Company. For most small businesses, this will be the Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS).

Foreign (non-US) businesses that do not have an EIN must provide the legal entity’s number or other similar identification number issued by the foreign government. Foreign businesses must provide the jurisdiction of the identification.

Jurisdiction of formation or first registration

The BOI form (online or PDF) first asks for the country where the Reporting Company was formed.

If the Reporting Company was formed in the United States, the form asks for the state or tribe where the Reporting Company was formed.

If the Reporting Company was formed in a foreign country, the form asks for the “state of first registration.” This is the state where the Reporting Company first registered to do business in the United States.

Current U.S. address

The current U.S. address for the BOI Report is the Reporting Company’s principal place of business in the United States. The principal place of business is the location where the Reporting Company’s officers, employees, or agents primarily direct, control, and coordinate the activities of the Reporting Company.

For foreign Reporting Companies, the current U.S. address is where the company conducts business in the United States.

Part II. Company Applicant Information

A Company Applicant is an individual who files an application to form a Reporting Company or registers a Reporting Company to do business in the United States. These are individuals who file, or cause someone to file, Articles of Incorporation or Articles of Organization with a Secretary of State or similar office.

For example, if you hire a lawyer to form a corporation for you, both you and the lawyer are Company Applicants. If you file Articles of Incorporation yourself, you are the Company Applicant.

Existing reporting company

The Company Applicants part of the report starts with a checkbox labelled “Existing reporting company.” This is an important checkbox. FinCEN only requires companies formed after January 1, 2024 to report the Company Applicants.

If the Reporting Company was formed before January 1, 2024, the Company Applicants section of the BOI Report is optional. If the Reporting Company was formed after January 1, 2024, the Company Applicants section of the BOI Report is required.

FinCEN ID - Company Applicant

The FinCEN ID is a unique identifier assigned by FinCEN to legal entities and individuals on request. The FinCEN ID is optional. If you do not have a FinCEN ID, you can leave this blank.

If, however, a Company Applicant has a FinCEN ID, then the BOI Report does not need to include any other information about the Company Applicant.

Company Applicant identifying information

The rest of the Company Application information has three sections:

- Full legal name and date of birth,

- Current address, and

- Form of identification and issuing jurisdiction.

There are a couple of important points about the Company Applicant information. First, the “Current address” asks whether the address is a Business or Residential address. It is not really a choice. You must provide the residential address of the Company Applicant, unless the Company Applicant is in the business of registering businesses.

For example, Eddy Entrepreneur starts a business. Eddy hires a Laura Lawyer to form a corporation for him. Both Eddy and Laura are Company Applicants. Eddy’s address is his home address. Laura’s address is her law office address.

Second, Company Applicants must prove their identity by providing government issued identification. The “Form of identification and issuing jurisdiction” asks for the type of identifying document and an image of the identification.

Identifying document types include:

- State-issued driver’s license,

- State-issued identification card,

- U.S. passport, or

- Foreign passport.

You must upload an image of the identification for every Company Applicant.

Part III. Beneficial Owner Information

The Beneficial Owner information must be completed for each Beneficial Owner of the Reporting Company.

Parent/Guardian information instead of minor child

The section starts with a checkbox labeled Parent/Guardian information instead of minor child. This checkbox is for a minor child who is a Beneficial Owner. If the Beneficial Owner is a minor child, the BOI Report must provide the name, date of birth, and address of the parent or guardian of the minor child, instead of the minor child’s information.

FinCEN ID - Beneficial Owner

The BOI Report then asks for the FinCEN ID of the Beneficial Owner. The FinCEN ID is a unique identifier assigned by FinCEN to legal entities and individuals on request. The FinCEN ID is optional. If you do not have a FinCEN ID, you can leave this blank.

Like the Company Applicant section, if a Beneficial Owner has a FinCEN ID, then the BOI Report does not need to include any other information about the Beneficial Owner.

Exempt entity

Next, the BOI Report has a checkbox labeled Exempt entity. This checkbox covers a less common situation for most small businesses. If a Beneficial Owner is an exempt entity, the BOI Report must provide the name, address, and identifying information of the exempt entity.

For example, Sally and Bob own a business and have an outside investment from a venture capital company. All three are Beneficial Owners. Sally and Bob are individuals. The venture capital company is an exempt entity. Sally and Bob must provide their personal information. The venture capital company must provide its name, address, and identifying information. The owners of the venture capital company do not need to be listed.

Beneficial Owner identifying information

The rest of the Beneficial Owner information has three sections:

- Full legal name and date of birth,

- Residential address, and

- Form of identification and issuing jurisdiction.

Note that the Beneficial Owner information asks for the residential address of the Beneficial Owner. There is no option for a business address.

Like the Company Applicant section, Beneficial Owners must prove their identity by providing government issued identification. The “Form of identification and issuing jurisdiction” asks for the type of identifying document and an image of the identification.

When to file the BOI Report?

You must keep the BOI Report up to date. The CTA imposes a continuing obligation to report Beneficial Ownership information, even after the initial report is filed.

FinCEN has defined four events that trigger the obligation to file a BOI Report:

- The initial report,

- Discovery of an error or omission in a prior report,

- Change in beneficial ownership information, and

- Change in exempt status for the Reporting Company.

The reports themselves are not difficult to file. The challenge is keeping track of the events that trigger the obligation to file a BOI Report and the data for the reports.

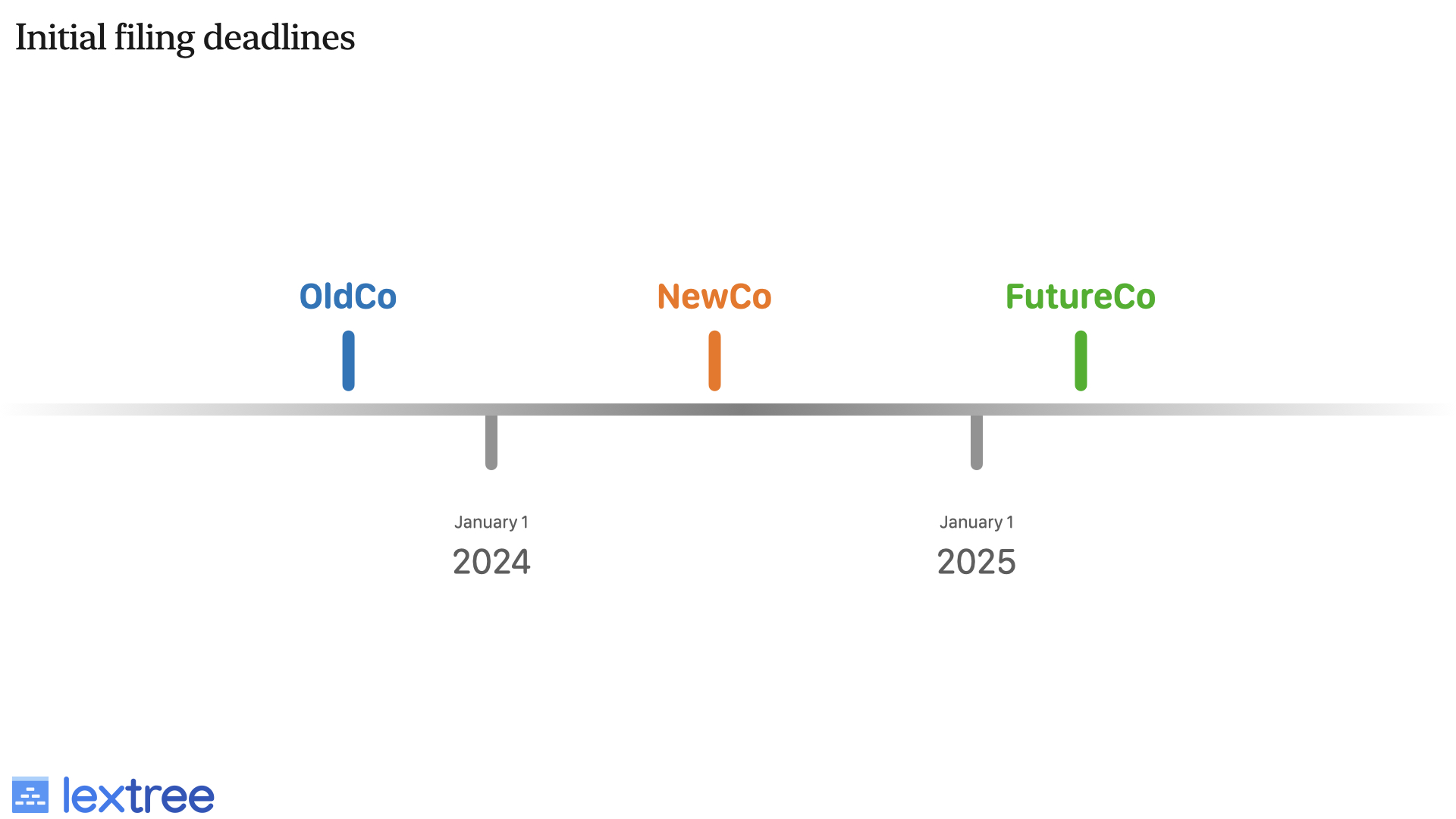

This initial report deadline varies based on the date for formation or first registration of the Reporting Company. The deadline for reports, other than the initial report, is 30 days from the date of the event that triggers the obligation to file the report.

Initial report

The deadline on the initial report depends on when the Reporting Company was formed or registered to do business in the United States.

| U.S. Registration Date | Deadline |

|---|---|

| Before January 1, 2024 | December 31, 2024 |

| During 2024 | 90 days from registration |

| After January 1, 2025 | 30 days from registration |

The initial report needs to include the information described in What is a Beneficial Ownership Information (BOI) Report?.

Correct prior report

You have 30 days to fix errors or omissions in a prior report. The deadline is 30 days from the date that you discover or should have discovered the error or omission.

This is very important. Ignorance of the error is not an excuse. You must fix errors or omissions within 30 days of the date that you discover or should have discovered the error or omission. This means you need entity management software to track and manage Beneficial Ownership Information.

Penalties for failure to correct errors or omissions are $500 per day, up to $10,000. There is a safe harbor for errors or omissions that are corrected within 90 days of the BOI report with an error.

Update prior report

You have 30 days to file an updated BOI Report if there is a change in the Beneficial Ownership information. The deadline is 30 days from the date that you discover or should have discovered the change in Beneficial Ownership information.

FinCEN is quite clear that any change in Reporting Company or Beneficial Ownership information triggers the obligation to file an updated BOI Report. This includes changes in the name, address, or identification information of a Beneficial Owner.

Beneficial Owners must report their personal residence. That means that if they move at any time, you must update the BOI Report for all companies where they are a Beneficial Owner.

Reporting Company change event examples

If the Reporting Company files a new fictitious business name, the Reporting Company must file an updated BOI Report.

A new CEO or other senior officer triggers the obligation to file an updated BOI Report.

This obligation is the reason that CTA compliance is unique. It is a continuing obligation. You must keep the BOI Report up to date.

However, there is “no requirement to report a company’s termination or dissolution.”5

Newly exempt company report

If the Reporting Company is no longer required to file BOI Reports, the Reporting Company must file a newly exempt report. The deadline is 30 days from the date that the Reporting Company becomes exempt.

There is a checkbox for newly exempt companies.

What Are the Penalties for Non-Compliance?

The penalties for non-compliance with the Corporate Transparency Act are severe. The penalties are designed to ensure that businesses comply with the law.

Civil penalties

$500 per day is the civil penalty for willful failure to file a BOI Report. That penalty also applies for willful filing of a false or fraudulent information on a BOI Report.

Criminal penalties

Criminal penalties include up to 2 years in prison and/or fines up to $10,000.

That probably means performing due diligence on the Beneficial Ownership information provided by your investors and partners. It also means keeping track of the deadlines for filing BOI Reports.

Conclusion

The Corporate Transparency Act is a significant new law that requires small businesses to file Beneficial Ownership Information (BOI) Reports with the Financial Crimes Enforcement Network (FinCEN). The law is designed to prevent money laundering and other financial crimes.

The law targets small businesses. Get legal advice and act quickly to avoid penalties.

31 C.F.R. § 1010.380(c)(1) (2023), Code of Federal Regulations Final Rule (last visited January 31, 2024). ↩︎

“SOI Tax Stats - Integrated Business Data” for 2015. Internal Revenue Service (IRS). ↩︎

“Small Business Profiles for the States, Territories, and Nation 2022,” Small Business Administration, Office of Advocacy, p. 2. ↩︎

“Small Entity Compliance Guide: BOI Beneficial Ownership Information Reporting Requirements,” Financial Crimes Enforcement Network, U.S. Department of the Treasury. Version 1.1, December 2023. p. 18. ↩︎

“Small Entity Compliance Guide: BOI Beneficial Ownership Information Reporting Requirements,” Financial Crimes Enforcement Network, U.S. Department of the Treasury. Version 1.1, December 2023. p. 46. ↩︎